January 16, 2026

Why We Invested in Verna

Building the Operating System for Nature Restoration

Love Ventures invested £300k in Verna's $4M Seed round, co-led by NAP and Ubermorgen, alongside our friends at Concrete Ventures, Vanneck and Climate VC.

The UK is one of the most nature-depleted countries in the world. Without urgent action to address nature-related financial risks, the country could see a 12% drop in GDP. Yet until recently, there was no standardised way to measure, plan for, or monitor biodiversity enhancement projects. Enter Verna.

The Problem: Nature Projects Running on Excel and Paper

Before Verna, biodiversity projects were managed through an archaic combination of manual processes, Excel spreadsheets, and paper-based workflows. Ecologists would survey sites with pencil and paper, then spend hours translating complex ecological data into unwieldy Excel documents to calculate "biodiversity metrics."

The challenge went beyond just inefficient workflows. Set against a backdrop of broader nature recovery initiatives, regulations the UK's Biodiversity Net Gain requirements mandate that developers deliver a 10% improvement in biodiversity for any new development. However, without proper tools to measure, plan, and monitor these projects over the required 30-year compliance period, organisations were flying blind.

This created a perfect storm: regulatory pressure demanding measurable biodiversity outcomes, but no infrastructure to actually measure, track, or verify those outcomes at scale.

Although Verna’s early adoption has been driven by UK Biodiversity Net Gain regulation, the platform is intentionally designed for a much wider set of nature recovery use cases. In providing the shared infrastructure needed to plan, deliver, and monitor nature outcomes over long time horizons - whether driven by regulation, voluntary commitments, or investment requirements - Verna is uniquely positioned to support nature recovery well beyond a single policy or geography.

The Solution: An Operating System for Nature

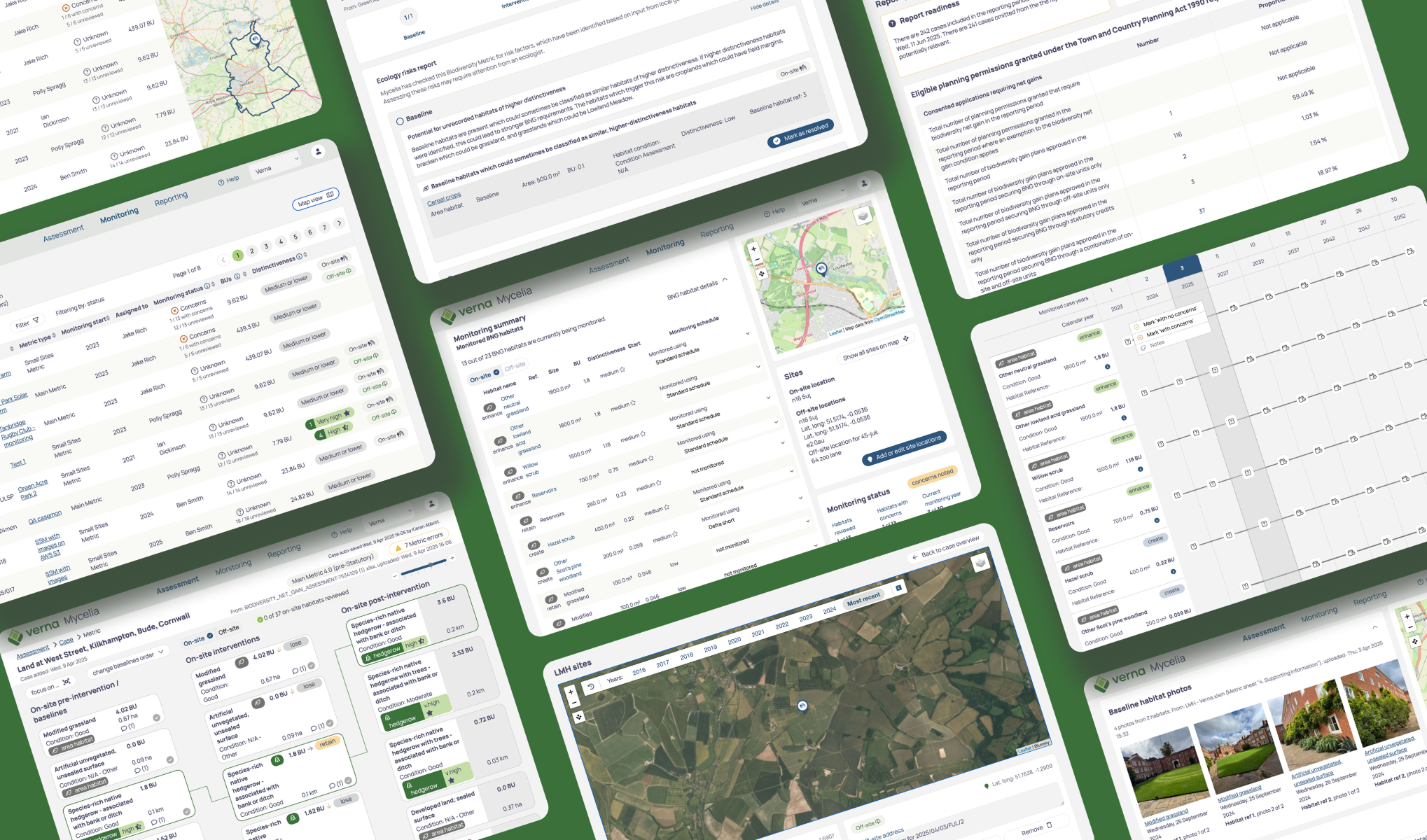

Verna's insight was deceptively simple but profound: biodiversity projects need the same kind of systematic approach that transformed other complex, data-heavy industries. Their platform, Mycelia, acts as the "operating system for nature restoration" – a single source of truth that connects all stakeholders across the biodiversity ecosystem.

What impressed us wasn't just the product's functionality, but how Verna positioned themselves at the centre of the ecosystem. Local planning authorities determine planning permissions and set monitoring requirements for developments. By embedding themselves with these regulators, Verna created a powerful flywheel effect: developers, infrastructure companies, ecological consultants, and nature project providers are all incentivised to use the same platform to streamline their interactions with local councils.

The team's domain expertise was immediately apparent. With backgrounds spanning climate strategy at BCG, computational physics at Cambridge, and leading the UK government's climate work, Rafi and Matthew weren't just building software – they were architecting the infrastructure for a new industry.

Why We Invested: The Convergence of Timing, Team, and Market Dynamics

Exceptional Early Traction: Captured strong market share amongst UK local planning authorities, while maintaining profitability, which signalled clear product-market fit. With 3,000 users across 100+ organisations using Mycelia, it was the quality of their customer base that was particularly compelling: local planning authorities are sticky, long-term customers with statutory requirements to use biodiversity monitoring tools for 30-year compliance periods.

First-Mover Advantage in a Global Market: The UK's Biodiversity Net Gain framework is being watched globally as a model for nature enhancement policy. The EU Nature Restoration Law, US state methodologies, and international interest from regions like California and Saudi Arabia suggest Verna's UK success positions them perfectly for global expansion.

Defensible Moat Through Data and Network Effects: As more biodiversity projects flow through Verna's platform, they accumulate the most comprehensive dataset of nature project outcomes. This creates a powerful data moat – enabling predictive analytics on project success likelihood and establishing Verna as the authoritative source for biodiversity benchmarking.

The Right Team at the Right Time: Rafi and Matthew combine technical depth with commercial acumen and deep government relationships. Having lived this challenge personally through their policy work, they understand both the scientific complexity and the regulatory landscape. Their measured, authoritative approach – more policy experts than typical disruptive entrepreneurs – actually works in their favour in this heavily regulated market.

The Market Shift: From Climate to Biodiversity

We're witnessing a fundamental shift in how businesses approach sustainability. While climate action remains important, ecosystem collapse presents more immediate business risks than gradual climate change. Companies are backing off ambitious climate goals but doubling down on biodiversity commitments. Global investors managing $21 trillion in assets are demanding biodiversity action, and new nature-focused facilities like HSBC's $1B fund signal serious capital deployment ahead.

The timing couldn't be better. As the UN has duly noted: "Don't focus on climate action at the expense of nature." Verna is building the infrastructure for this transition.

Looking Ahead: Scaling the Operating System

With established customer traction and strong renewal rates, Verna has proven their model with local planning authorities. Now they're expanding into the broader ecosystem: ecological consultants are increasingly adopting the platform.

The next prize lies in large corporate customers. Companies with extensive land holdings and binding biodiversity targets represent the future of Verna's revenue growth. Early enterprise pilots demonstrate how the core platform can be adapted for corporate use cases while maintaining the fundamental infrastructure.

International expansion is already underway, with inbound interest from California, Saudi Arabia, and Canadian provinces. The phased approach – leveraging regulatory frameworks that already exist or are emerging – provides multiple paths to global scale.

Why Love Ventures

At Love Ventures, we back founders building fundamental infrastructure for emerging markets. Verna represents exactly this opportunity: a team with deep domain expertise building the essential tools for a market that's shifting from regulatory requirement to economic necessity.

Our investment supports Verna's expansion beyond the public sector into enterprise sales, international markets, and the development of AI-enabled analytics that will make biodiversity project outcomes more predictable and successful.

As biodiversity becomes as regulated and measured as carbon emissions, Verna is positioned to become as essential to nature restoration as Stripe became to payments or Salesforce to customer management. That's the kind of infrastructure opportunity we're excited to back.