We are often asked by investors what EIS is and why they should care. The EIS (Enterprise Investment Scheme) is a scheme introduced by the government in 1994 to help small companies raise funds and grow by offering generous tax reliefs to investors.

Below we’ve outlined what these tax reliefs looks like for investors:

- Income Tax Relief. If you’re UK based and pay income tax, you can reclaim 30% of any EIS investment. So a £50k investment into an EIS qualifying startup or fund actually costs you £35k. You claim the 30% relief back in the following year’s self-assessment. You can also carry back relief to the previous tax year.

- CGT Exemption. If your investment does well and there is a liquidity event, your gains are exempt from CGT (providing you have held the shares for three years). You can also benefit from 100% capital gains tax deferral relief.

- Inheritance Tax Relief. Your investment is passed on without incurring any Inheritance Tax (providing you have held it for two years).

- Loss Relief. EIS provides for loss relief against income depending on the individual tax payer status.

Qualifying UK based taxpayers who are most suitable include those with significant income tax liabilities, those with capital gains made during prior tax years and those who have disposed of business assets qualifying for Business Property Relief (for IHT) within the last three years.

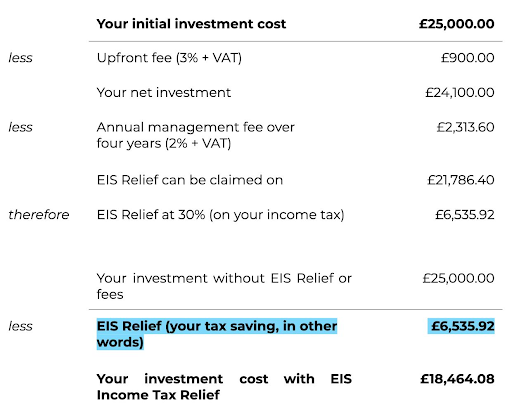

Below is a worked example of what Income Tax Relief can look like. All EIS funds operate different models – this is just an illustration of what a fund might charge and what the tax relief would look like.

If you have any questions on the above, please do get in touch. Alternatively here is a link to our fund host Sapphire Capital Partners LLP’s guide to EIS, and here is a link to HMRCs website for further detail.