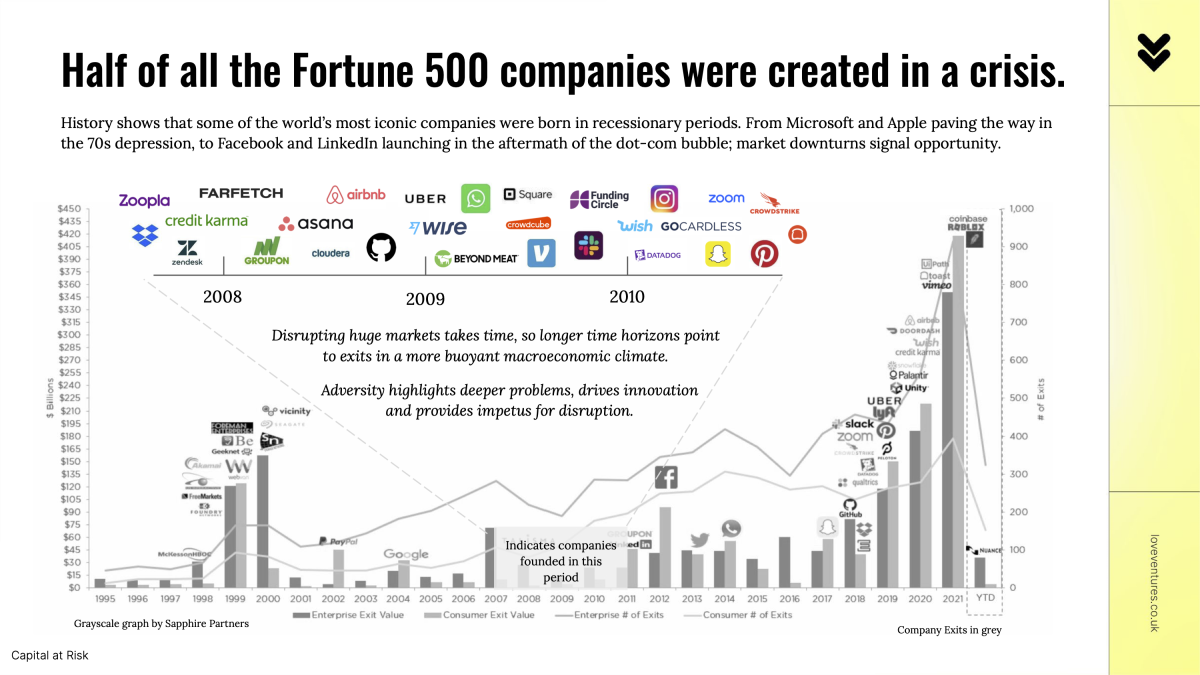

Half of all the Fortune 500 companies were created in a crisis.

Closer to home, 12 of the UK’s Unicorns were founded in the aftermath of the ‘08 Financial Crisis alone, with 4 of these exiting so far (Wise, FARFETCH, Funding Circle UK, Zoopla), and a further third of the UK’s ‘Soonicorns’ also born in this period.

As such, whenever a market downturn comes around we often hear the words of Benjamin Franklin ringing out loud and clear: ‘out of adversity comes opportunity’; it’s ringing especially loud in the UK right now. Many investors swear by this somewhat-overworked motto, so fortunately for them (beyond just wishful thinking) there’s also some truth in it.

With the help of a bunch of great literature we decided to unpack why, in venture more specifically, this might be the case.

1. The War on Talent: with widespread layoffs and fewer new roles, people start to look elsewhere: they pursue their entrepreneurial niggle (US new business registrations up 23% YoY since Covid, the UK up 30%), recent grads join startups over status-quo big corporates, and workers find new roles elsewhere i.e. peer-to-peer marketplaces thrive (think Uber drivers in ‘09).

2. “Must-have” versus “nice-to-have” value propositions: new, and very real, problems come to the fore in tough times. It’s the companies that build sticky mission-critical software that will win out.

3. Price Competitiveness: companies making people’s lives easier and cheaper thrive in a crisis: just look at AirBnB (Air Bed and Breakfast) and Groupon post the Financial Crash.

4. Unit economics over unnatural growth: with investor focus shifting towards clear paths to profitability, it’s the disciplined few that are built with a cash-conservative mindset who flourish longer term.

5. GTM innovation: freemium, anyone? Companies like Mailchimp are forced to adapt, so they offered up their service for free in 2008. The result: user growth from 85k to 450k within a year.

6. Competitive intensity drops away: a rising bar means fellow challengers fail to get funded, and incumbents struggle further still, meaning the toughest startups are rewarded with more time to innovate, to find product-market-fit, and to build lasting communities of users.

Either that or:

– It’s one big coincidence? (Kauffman’s landmark study would argue otherwise).

– There’s other factors at play: looking back at ‘08 it would be foolish to ignore the simultaneous explosion in the app economy and the rise of online marketplaces that, along with the emergence of the cloud, spurred on these iconic companies.

Whatever the case, the above accelerators remain: now it’s up to the next wave of startups to identify and drive forward the next paradigm-shifting trends.